Second Quarter Revenues Increased by 8% Year-Over-Year to $201.2

Or Yehuda, Israel, August 15, 2013 – Formula Systems (1985) Ltd. (NASDAQ: FORTY) a leading provider of software consulting services, computer-based business solutions, and proprietary software products, today announced its results for the second quarter of 2013.

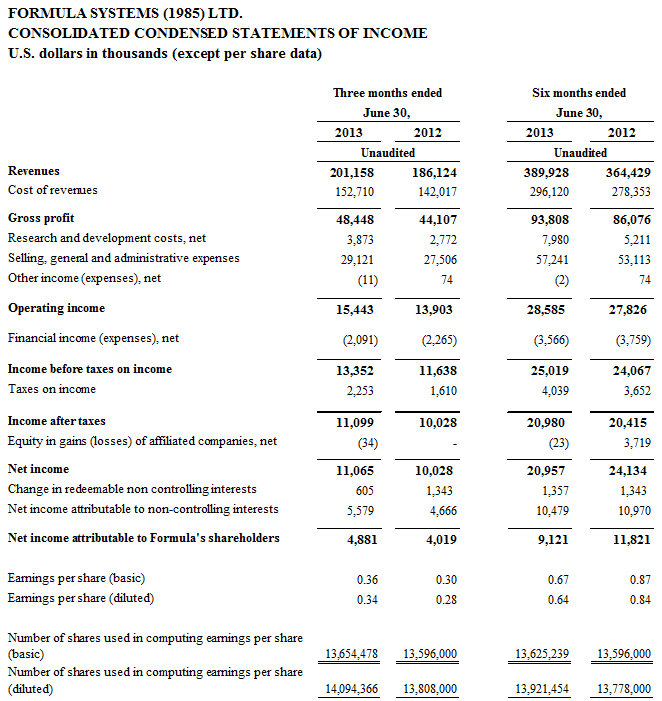

Financial Highlights for the Second Quarter Ended June 30, 2013

- Revenues for the second quarter ended June 30, 2013, increased 8% to $201.2 million compared to $186.1 million in the same period last year.

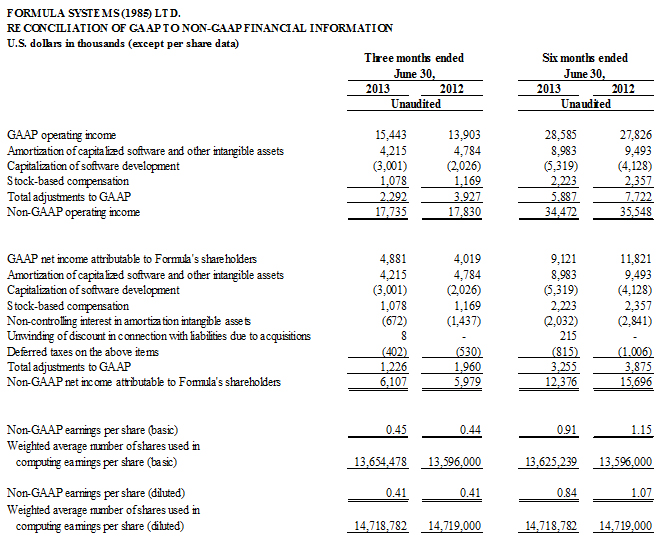

- Operating income for the second quarter ended June 30, 2013, increased 11% to $15.4 million, compared to $13.9 million in the same period last year; Non-GAAP operating income for the second quarter ended June 30, 2013, decreased 1% to $17.7 million, compared to $17.8 million in the same period last year.

- Net income for the second quarter ended June 30, 2013, increased 21% to $4.9 million (or $0.34 per fully diluted share) compared to $4.0 million (or $0.28 per fully diluted share) in the same period last year. Non-GAAP Net income for the second quarter ended June 30, 2013, increased 2% to $6.1 million compared to $6.0 million in the same period last year.

- On June 10, 2013, we declared a cash dividend in the amount of US $0.37 per share and in the aggregate amount of approximately US $5.5 million paid on July 2, 2013.

Financial Highlights for the Six-Month Period Ended June 30, 2013

- Revenues for the six-month period ended June 30, 2013, increased 7% to $389.9 million compared to $364.4 million in the same period last year.

- Operating income for the six-month period ended June 30, 2013, increased 3% to $28.6 million compared to $27.8 million in the same period last year; Non-GAAP operating income for the six-month period ended June 30, 2013, decreased 3% to $34.5 million compared to $35.5 million in the same period last year.

- Net income for the six-month period ended June 30, 2013, decreased 23% to $9.1 million (or $0.64 per fully diluted share) compared to $11.8 million (or $0.84 per fully diluted share) in the same period last year; Net income in 2012 included a net gain of $3.4 million resulting from the remeasurement of the Company’s investments, attributable to regaining controlling interest in Sapiens. Non-GAAP net income for the six-month period ended June 30, 2013, decreased 21% to $12.4 million compared to $15.7 million in the same period last year

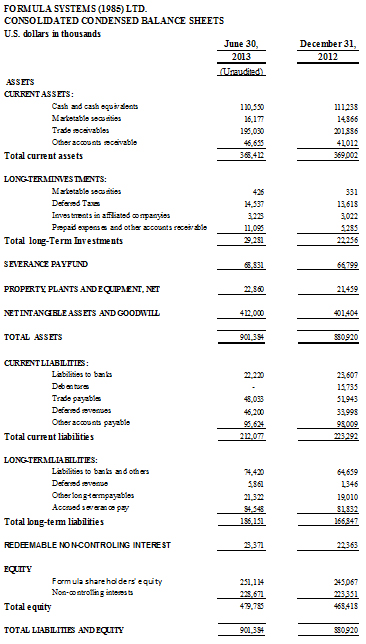

- Formula’s consolidated cash and short term and long term investments in marketable securities totaled approximately $127.2 million, as of June 30, 2013.

- Total equity on June 30, 2013 was $479.8 million, representing 53% of the total balance sheet.

Comments of Management

Commenting on the results, Guy Bernstein, CEO of Formula Systems, said, “I am happy to report the second quarter results which reflect continuing strong financial performance across all of our subsidiaries, a direct result of our effective resource management and long-term growth strategy. During this quarter, Matrix has improved its gross profit, operating profit and net income by rapidly responding to changing market conditions and declared a cash dividend of approximately NIS16.8 million (or NIS0.28 per share). Sapiens reached record quarterly revenues of $33.1 million thanks to increasing demand for its solutions across its major markets and continues to make investments in its business to keep its market-leading position. Magic which continued its double-digit growth rate by winning new and repeat business and expanding its professional service activities has just announced a dividend for the first half of 2013 in the amount of approximately $3.4 million (or $0.09 per share) reflecting its strong financial position.”

Non-GAAP Financial Measures

This release includes non-GAAP operating income, net income, basic and diluted earnings per share and other non-GAAP financial measures. These non-GAAP measures exclude the following items:

- Amortization of intangible assets derived from acquisitions;

- Research and development capitalization and related amortization;

- Share-based compensation;

- Unwinding of discount in connection with liabilities due to acquisitions; and

- Related tax effect of the above items.

Formula’s management believes that the purpose of such adjustments is to give an indication of Formula’s performance exclusive of non-cash charges and other items that are considered by management to be outside of Formula's core operating results.

This non-GAAP financial measures are not in accordance with, or an alternative for, generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. Formula believes that non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with Formula’s results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate Formula’s results of operations in conjunction with the corresponding GAAP measures. Please refer to the Reconciliation of Selected Financial Metrics from GAAP to Non-GAAP tables below.

About Formula

Formula Systems (1985) Ltd. is a global information technology company principally engaged, through its subsidiaries and affiliates, in providing software consulting services, developing proprietary software products, and providing computer-based business solutions.

For more information, visit www.formulasystems.com.

Press Contact:

Formula Systems (1985) Ltd.

+972-3-5389487

Except for any historical information contained herein, matters discussed in this press release might include forward-looking statements that involve a number of risks and uncertainties. Regarding any financial statements, actual results might vary significantly based upon a number of factors including, but not limited to, risks in product and technology development, market acceptance of new products and continuing product conditions, both locally and abroad, release and sales of new products by strategic resellers and customers, and other risk factors detailed in Formula's most recent annual report and other filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.